Things are getting expensive, the inflation rate is increasing, our salaries remain the same, so how to survive?

Well, there are many ways that you can do to save some money every month to reduce your financial stress, and I am going to share with you what I did and how to save money in Malaysia.

4 Simple Tips on How to Save Money in Malaysia

Let’s go straight to the points, here are the 4 simple tips that I used to save money in Malaysia.

Tip #1 – Use a Groceries Shopping App to Buy Groceries

From my experience, the money I saved by using a grocery shopping app like HappyFresh always saved more than buying from the hypermarket directly.

Not just the money, but I also save petrol, time, and hassle as HappyFresh will help me to shop for the groceries and deliver them to my doorstep.

It is a safer way to shop for groceries during the pandemic and this will make the supermarket less crowded.

If the items you added to the cart are out of stock, their friendly shoppers will chat or call you for the replacement.

The app is easy to use, and their shoppers and delivery man are friendly.

There are two tips to save more on HappyFresh.

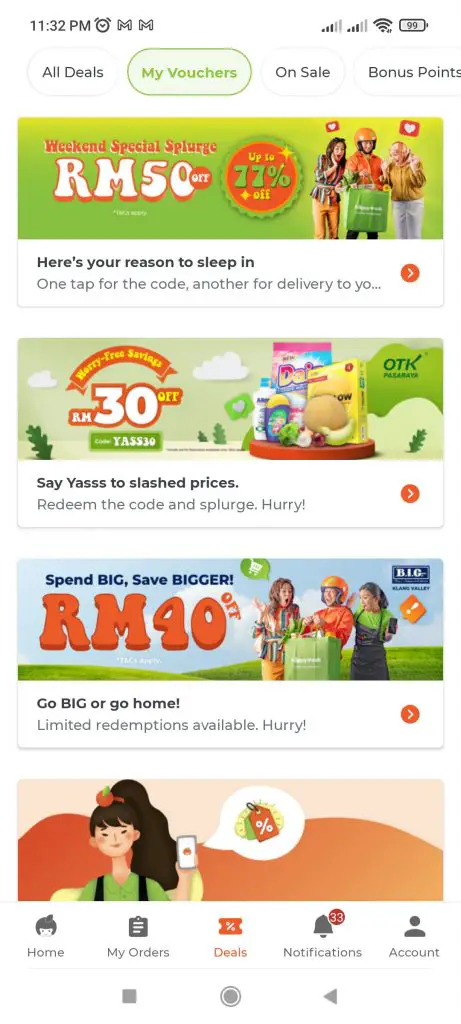

First, use the promo code.

HappyFresh gives out different promo codes from time to time, so apply it during checkout the enjoy the saving.

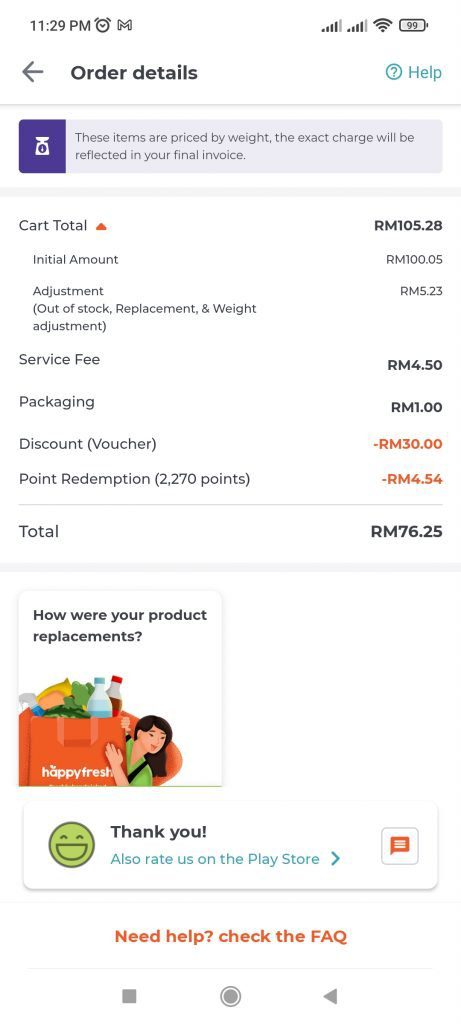

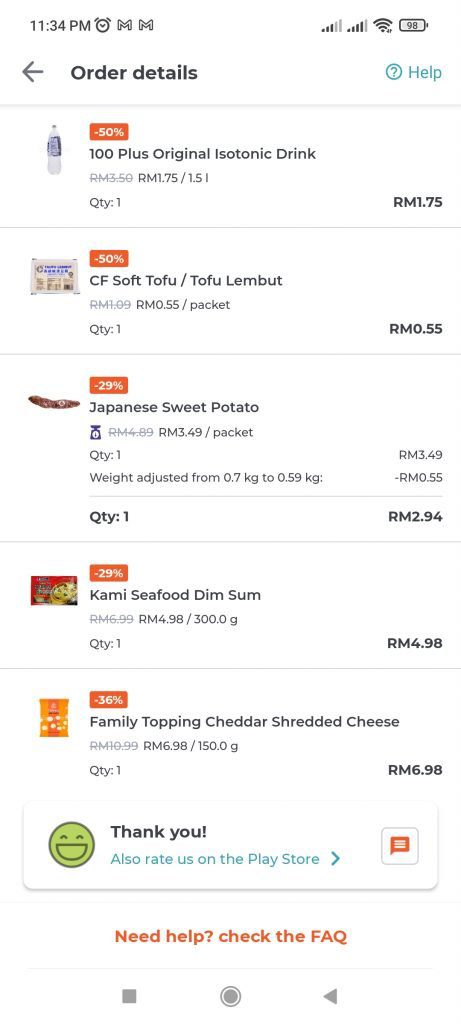

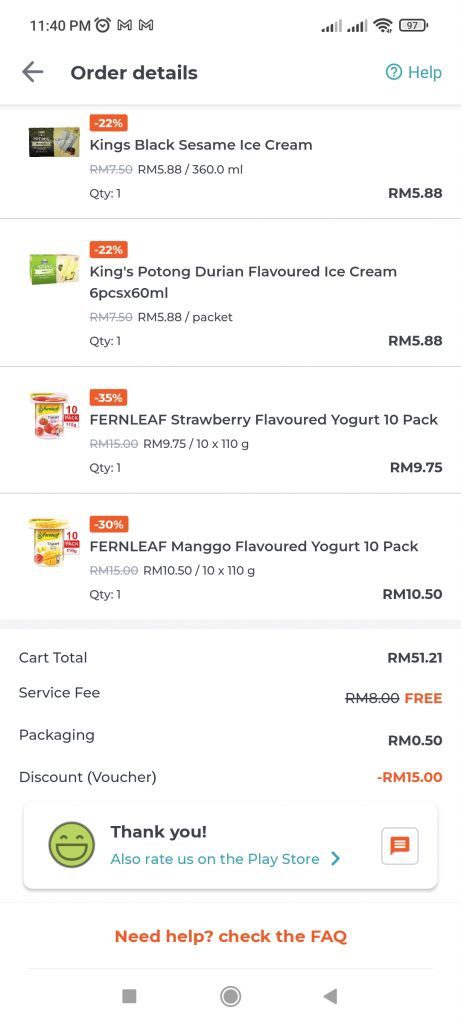

Here is one of my orders with HappyFresh that saves me RM30 (about 30% discount)!

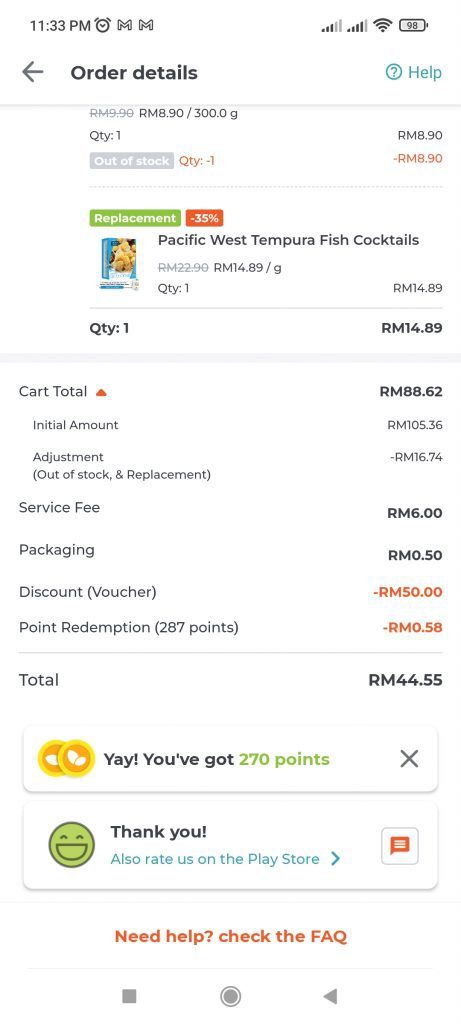

Here is another order that saves me RM50 (about 56% discount)! I haven’t included the money saved from discounted items.

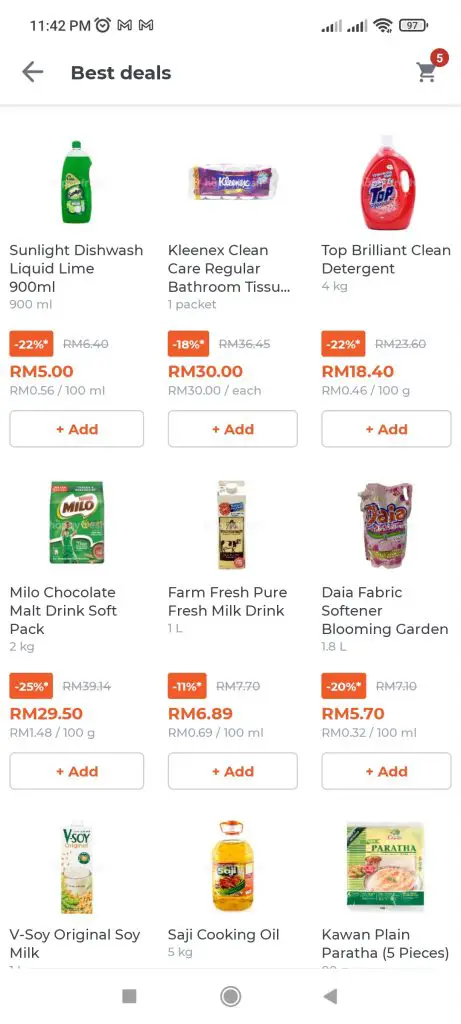

Second, buy the promotion items.

HappyFresh runs their own promotion on their app, and a lot of time much better than the hypermarket itself.

For example, when I go to Lotus’s hypermarket, a 1.5L of 100plus will cost me RM3.50, but buying through HappyFresh only cost RM1.75 due to their promotion.

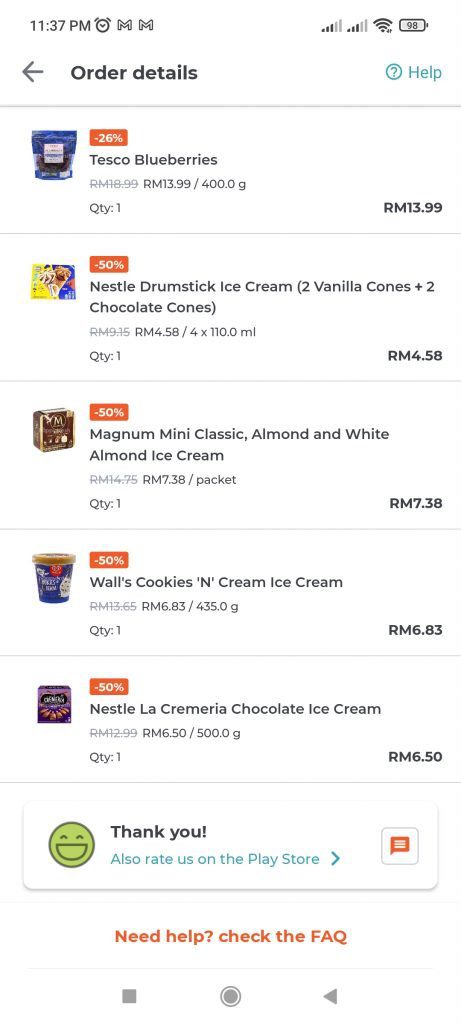

How about 50% OFF your favourite Magnum ice cream?

Want to save more? Just buy the promotion items and use a promo code!

You will also get reward points that you can redeem as cashback during your next order.

If you don’t have a HappyFresh account yet, here are the steps to get RM30 OFF for your first purchase:

- Click this link here

- Download the HappyFresh app and sign up for an account (quick process)

- Set your location and start shopping from any grocery stores

- Checkout and set the delivery time

- Apply the code during checkout and save money instantly

- Wait for the groceries to arrive at your home

Tip #2 – Make Use of Credit Cards

1. CIMB e Credit Card

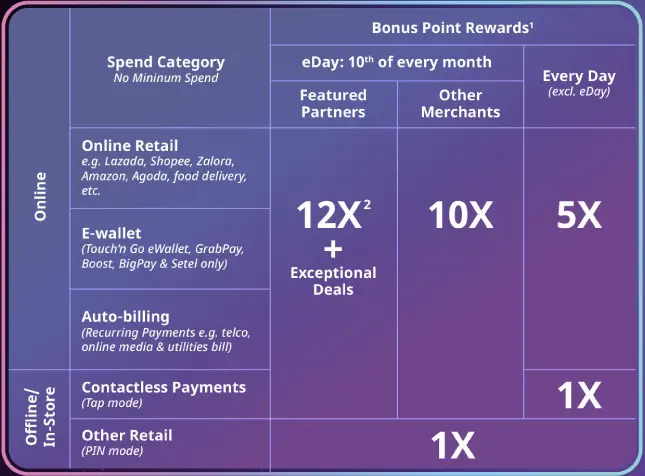

CIMB e credit card is the best credit card for e-wallet top-up and online purchase.

If you top up your e-Wallets like BigPay, GrabPay, TnG, ShopeePay, and Lazada Wallet on the 10th of every month with the CIMB e credit card, you will receive 10x points, which require you to top up a total of RM2,000 to receive 20,000 points (max), equivalent to RM50 cashback per month.

If you spend on their featured partners on the 10th of the month, you can receive 12x points.

You can then use your e-Wallets to pay bills, buy groceries, buy things on Shopee and Lazada, buy foods, service your car, and more.

I always hit the 20,000 max point every month since I received my CIMB e credit card, and then redeem the RM50 cashback, that’s RM600 cash value every year.

Also, the CIMB e credit card annual fee is waived until 31 December 2025, so I only need to pay the RM25 service tax.

You can apply the CIMB e credit card on CIMB website or RinggitPlus conveniently.

2. Citi Cash Back Credit Card

Citi Cash Back credit card is the best cash back credit in Malaysia.

I always use my Citi Cash Back credit card to pump petrol and top up Grab as it only requires RM500 spending to enjoy the 10% cashback benefit for each of the 4 categories (petrol, Grab, dining, and groceries), capped at RM10.

For instance, if you spend RM100 a month to pump petrol, you will get RM10 cashback, and that is RM120 cash per year, enough to cover the RM25 service tax.

Then, top up another RM100 to Grab Pay to receive RM10 cashback.

There are many ways to spend the money in your GrabPay wallet – making payments on online platforms, offline retail stores, restaurants, and more.

Just the petrol and GrabPay alone already earn you RM240 cashback a year, minus the RM25 service tax you still have RM215 net earning by just using a credit card.

I haven’t included the spending of dining and groceries, so the cashback earning could be more if you dine out occasionally and use the credit card to buy groceries.

Let’s say I spent RM100 on GrabPay top-up, RM100 on petrol, and RM100 on dining and groceries, and the other RM200 on something else, I will get RM30 (RM10 from Grab, RM10 from petrol, RM10 from dining and groceries) out of these RM500 spent, and that is 6% cashback as overall.

Just for your information, the annual fee of Citi Cash Back credit card is waived for the first 3 years, and after that, you can always call their customer service to waive the annual fee.

Also, when you apply for the Citibank credit card, there is always a signup gift like RM500 cashback, Lazada voucher, luggage bag, smartphone, and more, so make sure to check out the Citibank website and RinggitPlus to see who offer a better signup gift.

The Citi Cash Back Platinum credit card gives 10% cashback and is capped at RM15 for each category, but requires RM1,500 spending a month.

So, if you can spend more than RM1,500 a month, then you may consider applying for the Citi Cash Back Platinum credit card, otherwise, apply for the Citi Cash Back credit card for a lower spending requirement.

3. BigPay Prepaid Card

BigPay prepaid card is a great card to use as a buffer or intermediate card to store money and receive cash back rewards.

For example, if I use my CIMB e credit card to pay for my car service, I will only receive 1 point per RM1 (equivalent to 0.25% cashback), but if I use my CIMB e credit card to top up BigPay card on the 10th of the month, and then use it to pay for my car service, I will receive 10 points per RM1 (equivalent to 2.5% cashback) as it counts as e-Wallet top-up.

Also, since I use multiple e-wallets like GrabPay, TnG, Boost, ShopeePay, and Lazada Wallet, if I top up each of them on the 10th of the month, I will run into a situation – where some of the e-wallets are low in balance whereas the other e-wallets have excess balances, and the problem is I can’t transfer money among these e-wallets.

By using the BigPay as an intermediate card, I can then top up my e-wallet on demand whenever I need it.

In my case, I always top up RM1,000 to my BigPay card using the CIMB e credit card every 10th of the month, and then spend it elsewhere. The monthly top-up limit for the BigPay card using credit cards is RM1,000.

BigPay card is free to apply, has no annual fee, and does not need to pay service tax.

Besides, it has 0% foreign transaction fees, so if you travel overseas, swiping the BigPay Prepaid Card often gives you a better rate compared to exchange for cash.

I always used it to buy things on Lawson when I am in Japan.

You can also use it to transfer money internationally if you have a family member live in overseas.

- Download the BigPay mobile app here

- Apply for the BigPay card

- Enter the referral code “2EQJQSC8HD“ during the application process to receive an RM10 cash reward after activating your BigPay card.

Tip#3 – Make Use of E-Wallets

E-wallets like GrabPay, TnG, and Boost provide rewards when you spend using the wallet.

Out of these 3, the best one is GrabPay.

I use GrabPay to order Grab food and Grab rides and make payments to online and offline retail stores such as HappyFresh, 99Speedmart, Pharmacy, and more.

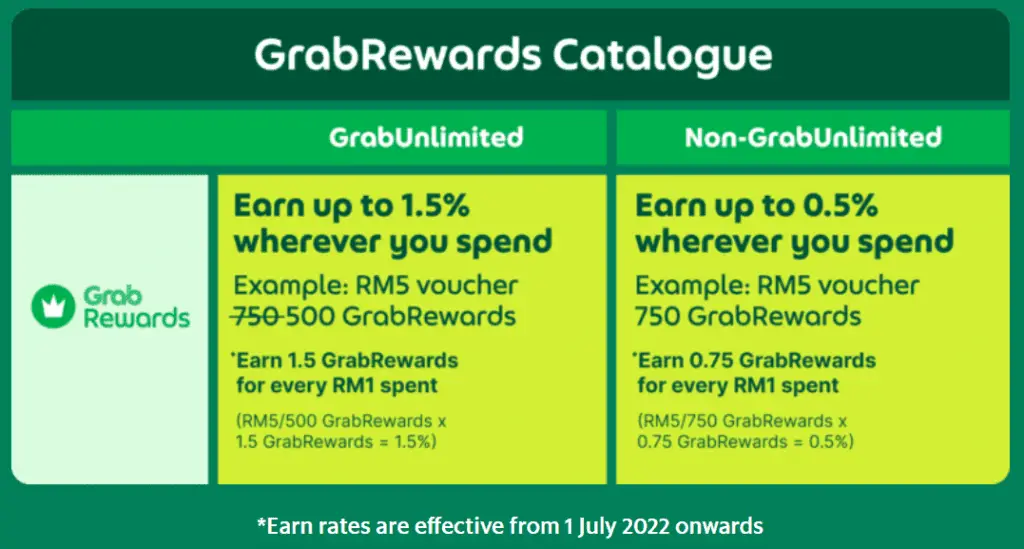

Update:

Starting 1st July 2022, the Grab reward point you can earn per RM1 spent is reduced to 1.5 for GrabUnlimited and 0.75 for Non-GrabUnlimited.

GrabPay gives 3 points per RM1 spent, and the RM5 Grab rides voucher needs 640 points.

If I spent RM214, I would get 642 points which can be redeemed for an RM5 Grab rides voucher.

So, the return is RM5 / RM214 x 100% = 2.34% cashback.

By adding the 10% cashback from the Citi Cash Back credit card top-up, the return becomes 12.34% 10.5% for Non-GrabUnlimited or 11.5% for GrabUnlimited.

Or by adding the 2.5% cashback from CIMB e credit card top-up, the return will be 4.84% 3% for Non-GrabUnlimited or 4% for GrabUnlimited.

Remember, all these savings add up over time.

Boost used to be good with the random cashback, but after changing to the star reward system, the reward drops to very little, so I only use it to pay bills as GrabPay does not reward points for bill payment.

I use the Touch n Go wallet for toll payment and pay hawkers in Kopitiam, Pasar Malam, and Pasar Pagi. I found that TnG is more widely accepted at these places.

Besides, the TnG GO+ feature provides 1.5% return p.a. and a limited period bonus interest up to 2% p.a., it is not much but still, better than no.

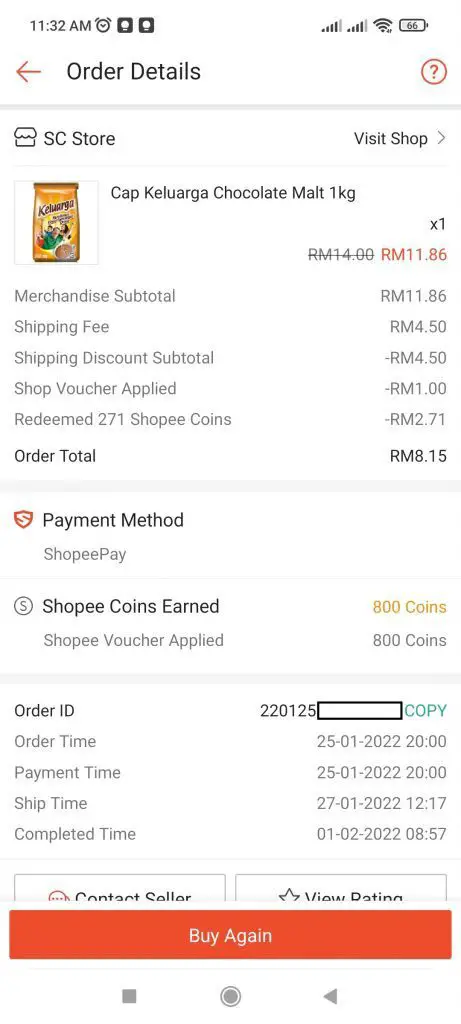

Tip#4 – Buy on E-Commerce Platforms Like Shopee and Lazada

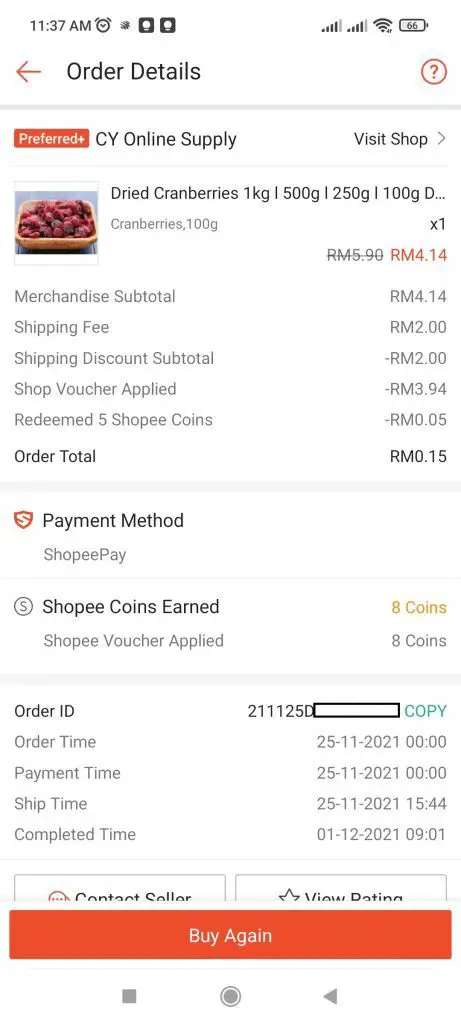

From my years of shopping experience, buying from Shopee or Lazada is cheaper than buying from a physical store, most of the time.

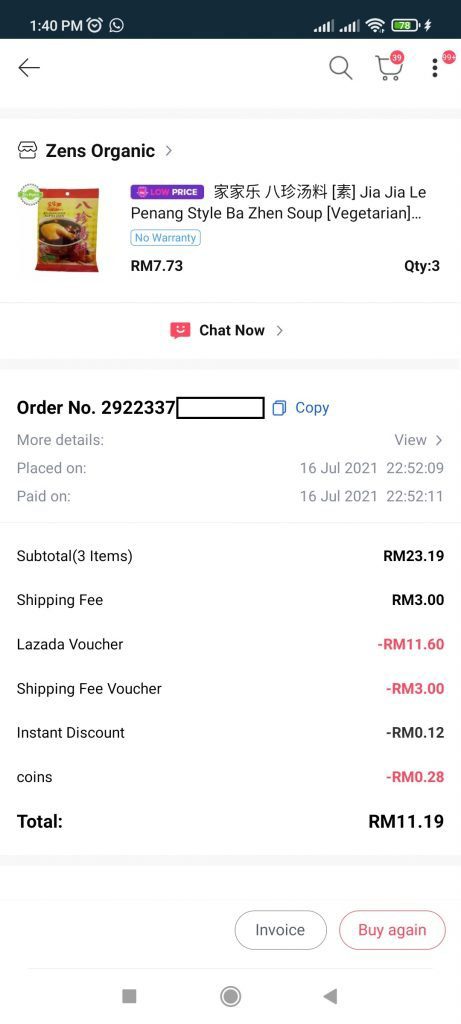

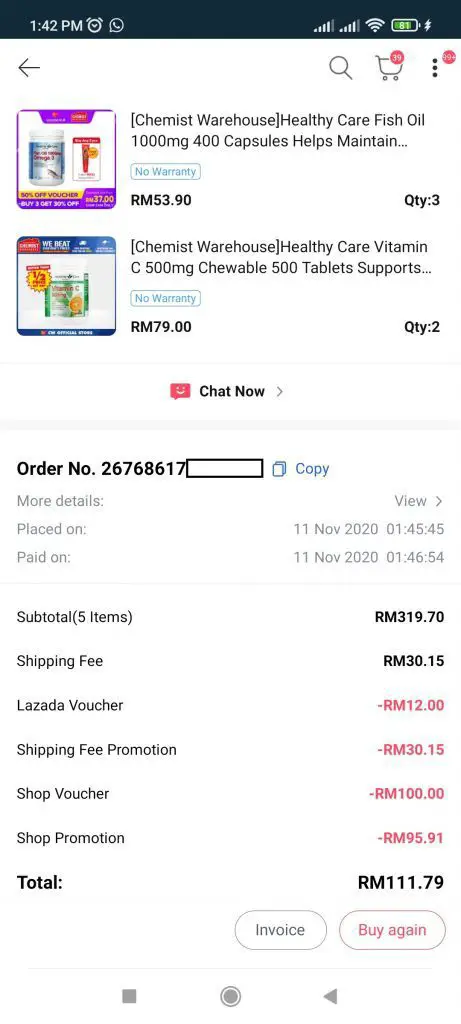

You can save even more when buying on sales days with free shipping and coins cashback vouchers.

For Shopee, buy on sales days like:

- 1.1, 2.2, 3.3, 4.4, 5.5, 6.6, 7.7, 8.8, 9.9, 10.10, 11.11, 12.12

- Payday sales (25th of every month)

- Festival days like New Year, Chinese New Year, Hari Raya, Christmas

For Lazada, buy on sales days like:

- 1.1, 2.2, 3.3, 4.4, 5.5, 6.6, 7.7, 8.8, 9.9, 10.10, 11.11, 12.12

- Payday sales (25th, 26th, 27th, 28th of every month)

- Festival days like New Year, Chinese New Year, Hari Raya, Christmas

- Special days like Valentines, Mother Days, Father Days, Lazada Birthday, and more

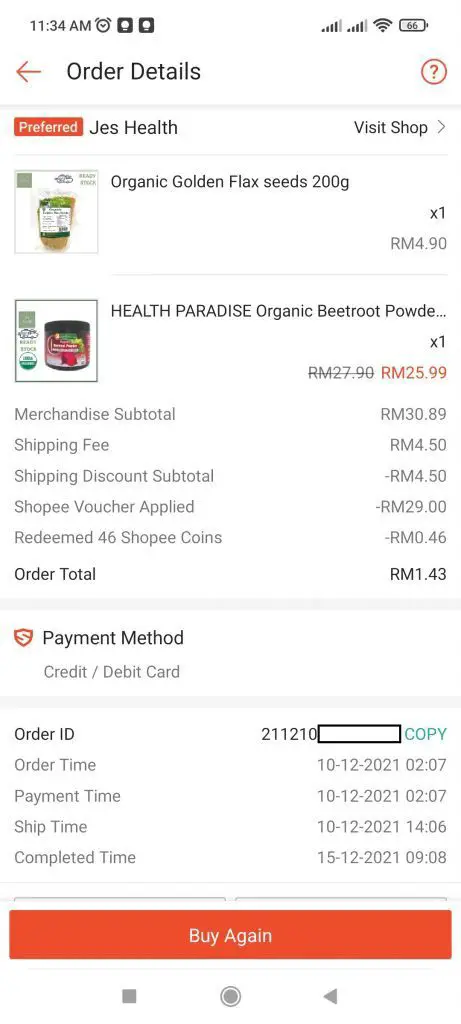

If you have the CIMB e credit card, there are special promo codes that you can apply on Shopee and Lazada to get RM29 OFF (min spend RM30) on the 10th, but it will run out very quickly, so make sure you check out at exactly 12 am on 10th of the month.

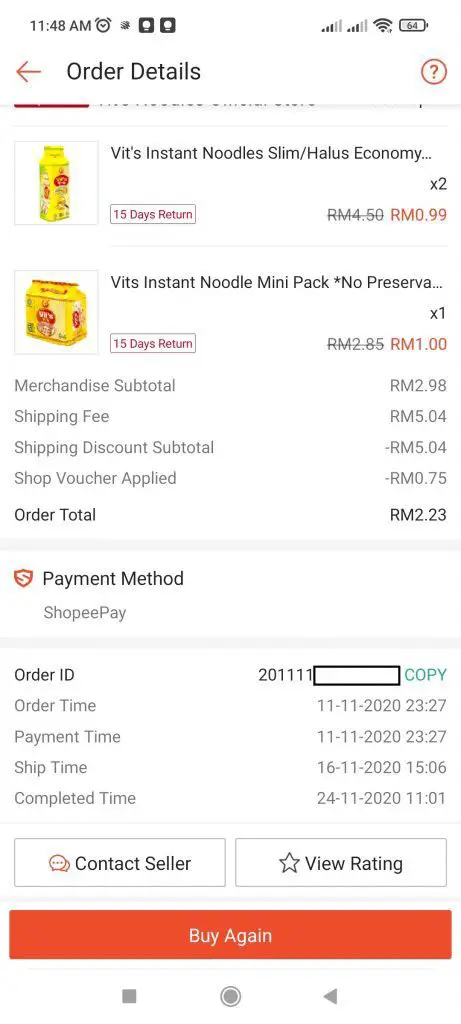

The total price is RM30.89, but I only paid RM1.43 (or RM1.89 if excluded the redeemed Shopee coins) thanks to the promo code and free shipping voucher, that’s about a 95% discount!

What to do on these sales days?

- Claim the free shipping voucher

- Claim the coin cashback voucher

- Add your items to the cart

- Apply the vouchers and checkout

Tip: The limited free shipping voucher and coin cashback may run out quickly, so try to check out earlier to enjoy the voucher. Most of the time, the greater the discount or cashback value, the faster it will run out.

Tip 2: Stock up dry groceries during sales. I buy and stock up a lot of dry groceries like toilet tissue and laundry liquid during big sales, so I ended up spending less and don’t have to worry about these items for the coming months or years.

How Much Can I Save from Shopping at Shopee and Lazada?

Just some quick math here:

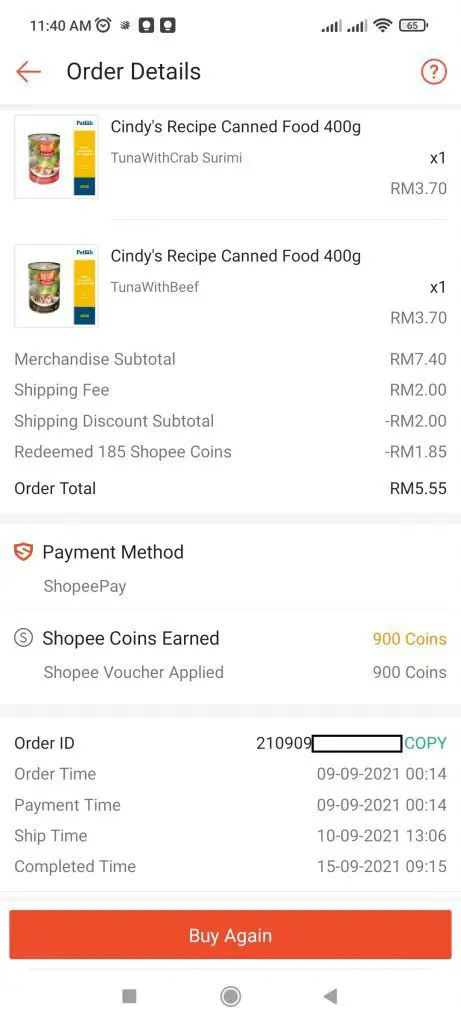

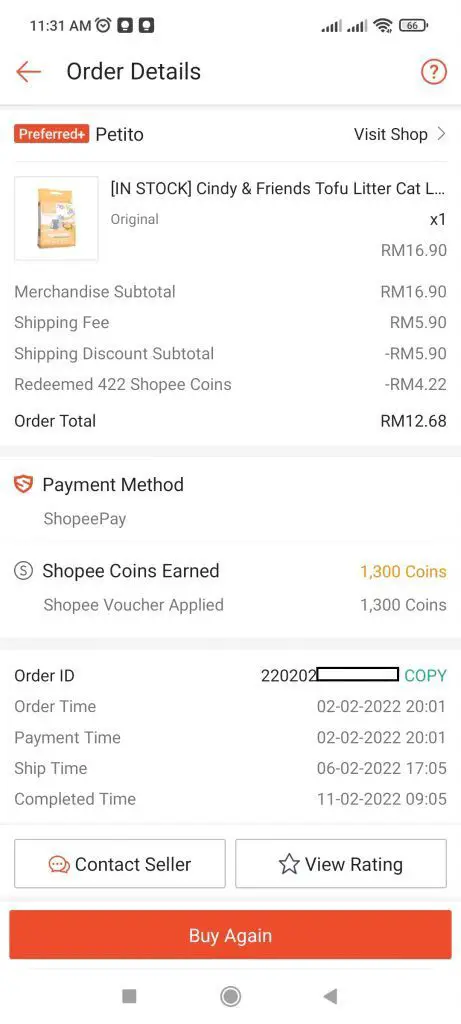

I need about 20 cans of 400g wet food for my cats each month.

If I buy at my nearby pet store, one canned wet food cost about RM4.50 on average, so the total will cost me RM4.50 x 20 = RM90 on canned food alone, I haven’t included the freeze-dried cat food and cat litter.

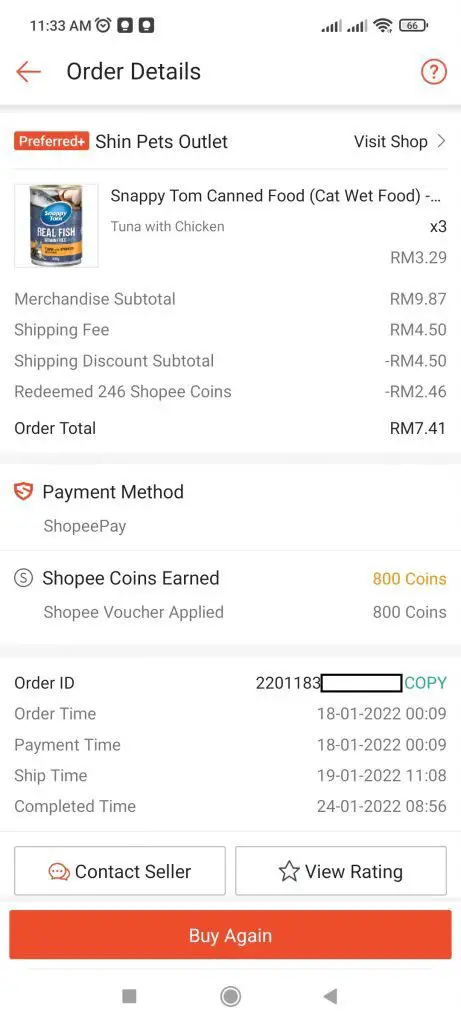

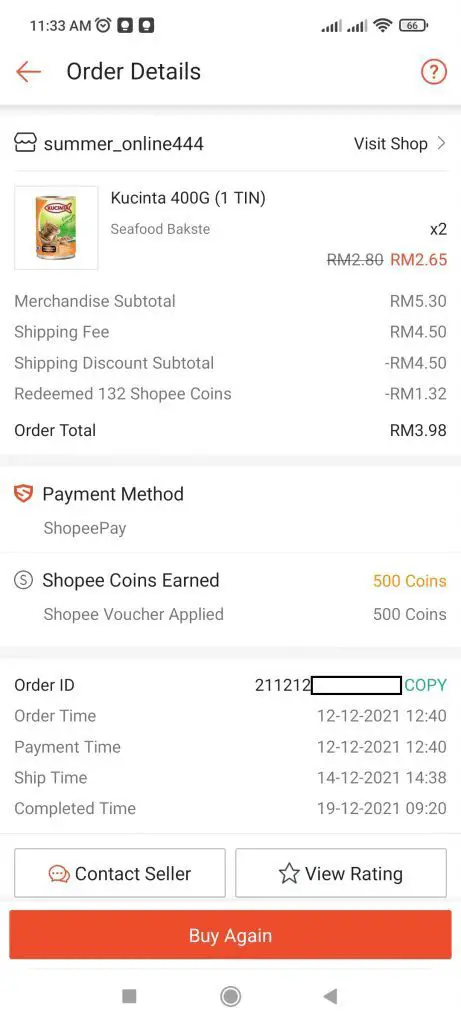

But if I buy on Shopee with free shipping and coins cashback, one canned wet food only cost me about RM1 on average (see my attached photo below), and that’s RM20 per month, saving me RM70 every month on just canned food alone.

Excluding the RM2.46 Shopee Coins redemption, 3 canned food cost me RM9.87 with 800 coins earned (RM8 value), so I only spent RM1.87 for 3 canned food, about RM0.60 per canned food vs retail price of RM4.50, that’s about 87% saving!

From the above screenshot, 2 Kucinta canned food cost about RM5.30 and I earned 500 Shopee coins from this purchase, which means I only paid RM0.30 for 2 canned food, which is RM0.15 for one! Super cheap, but this is not the best deal I get.

Here I bought 2 Cindy’s Recipe canned food with a total price of RM7.40, but Shopee gives me free shipping and 900 coins in return, which means I get the 2 canned food for free plus RM1.60 worth of Shopee coins! You won’t find this kind of deal in a retail store.

If include freeze-dried cat food and cat litter, I can save over RM100 a month by shopping at Shopee, and this amount add-up every month.

And these savings are just from my cats’ things! I haven’t included the money I saved from groceries, personal things, and more.

These are just from Shopee alone, I also often got some great deals at Lazada too.

And many more.

Conclusion: How Much I Save On Average?

On average, I save about RM300 to RM490 per month by using the above 4 tips:

- RM100 to RM200 monthly from buying groceries on HappyFresh.

- RM100 to RM200 monthly from online shopping at Shopee and Lazada.

- RM50 cashback from CIMB e credit card.

- RM20 to RM30 cashback from Citi Cash Back credit card.

- RM12 from GrabPay (~1,500+ points)

While this may not be a huge amount for some people, it could be a lifesaver for some families, especially those with no savings after expenses or with negative cash flow.

If you could save RM400 a month by implementing these simple tips, then after a year you will have RM5,000 cash in your bank account!

Read Next: